Last week I highlighted some interesting goings on in Japan.

Big Falls in the Price of Gold

You’d need to be living on a desert island not to have read some headlines regarding gold over the past few weeks. In this post I’m going to take a closer look at the move, and consider it in the context of gold volatility.

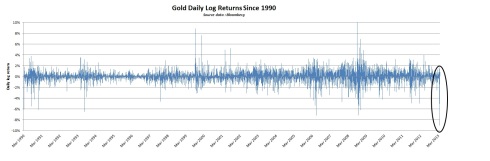

First, lets put the moves into context. We saw a 5% fall in the gold spot price on Friday 12th April, followed by a 9% fall on the following Monday. These were massive moves by any measure : the 20 year standard deviation of daily price changes is around 1%, so the move on Monday 14th was a 9SD event. Such a large fall had not happened in the last 20 years. An increase of that magnitude had happened only once, in September 2008.

The chart below visualizes the daily moves in the gold spot price over the last 20 years. We can clearly see the recent outlier – that’s one big move!

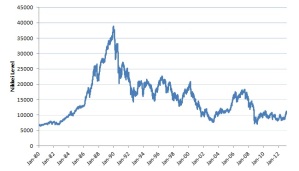

Furthermore, recent volatility had been quite low. The chart below shows the 1-month realised volatility of the gold price as well as the 1-month implied volatility (a measure of the market’s expectation of the volatility over the next month). Both had been high at times in the past, but had, prior to the recent falls, sunk to the lowest levels we’ve seen in the last 20 years.

High Volatility a new ingredient

In fact, implied and realised volatility had fallen to around 10%, meaning on 14th April we got roughly a whole year’s volatility in one day! Both measures of volatility have, not surprisingly shot higher following the move, which means we should expect a period of larger swings in price.

Looking at the relative changes in price so far this year (chart below), across a few different indices, we can see that while the gold price initially rose early in the year, it began a downward trend in February, in contrast to developed equity markets (which have trended higher since then) and wider commodity markets (which are broadly unchanged since then).

However the recent extreme falls in the gold price have fed through into other markets, with developed equities losing around 3% in total over the last week.

So far so familiar, probably. My point is that if we dig a little deeper into the gold volatility surface, we can un-earth some interesting facts.

Gold is different to Equities

Without getting too detailed, a volatility surface measures the price investors are willing to pay to insure against moves in the value of an asset. It also tells us about the possible direction of such moves. Equities for example almost always have volatility surfaces that are skewed toward put options – investors are worried about large falls and prepared to pay more for options that relate to large falls than those that relate to large gains. We know from experience that a large fall in an equity market is more likely than a large rise.

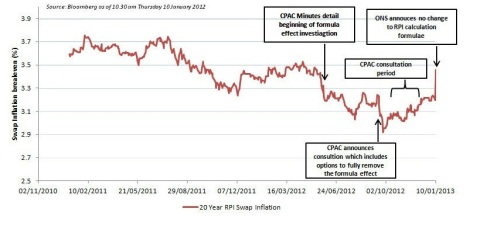

Gold is a little different. As Jonathan Eley pointed out in the FT over the weekend, the dynamics of the gold price are interesting. While it might be an inflation hedge over long, long periods, its day-to-day dynamics suggest it doesn’t always simply behave simply like a “safe haven” asset. Its volatility surface can be interesting too. Below I show the volatility surface at three different points in time.

Firstly, during August of 2011, a period of time where there was considerable stress in the markets. We can see that the volatility surface slopes upward from left to right – indicating that investors felt that at this point in time large moves in the gold price were more likely to the upside than the downside.

The second volatility surface is in the middle of last year. The surface has flattened – investors felt that large moves in the gold price were equally likely in both directions.

Finally, I show the volatility surface as of the middle of March this year (a full month before the big falls in the price). Interestingly, for short maturity options, the gold volatility surface had become downward sloping – investors had begun to feel that were a large move to take place, it was more likely to be on the downside than the upside.

Takeaways for investors

Well, gold is an interesting asset, with quite different dynamics to other asset classes. Sometimes it can “look” like a safe-haven asset which investors rush to in times of crisis, causing large upward surges in price. Other times it can look like a risky asset, and experience large downward moves in price.

Gold “bulls” will cite the fact that gold has supposedly retained its purchasing power over thousands of years, John Paulson famously runs a large proportion of his vast c$10bn of hedge fund assets in gold based share classes (as opposed to USD or EUR currency). Others will point out that recently gold lost 10% of its purchasing power in a single day, or 20% so far this year – how can that be a safe haven ?

I think the conclusion for investors is to be very clear about the role of gold in portfolios. The view that an investor is expressing by being long gold is

(1) expectations of cyclically much higher inflation – the sort generated by quite extreme shocks or changes in environment, perhaps as high as double digit per annum rises in price indices.

(2) expectations of the failure/end of a FIAT money system of currency and a return to the use of precious metals as a medium of exchange.

An investor which holds these views and expresses them through being long gold, then clearly has to accept some considerable possible volatility in that position compared to one measured in a FIAT money currency such as USD or EUR.